Are you searching for a practical solution to make money online? Look no further! We are thrilled to present “The Ultimate Guide to Making Money Online through Financial Planning Services.” This comprehensive guide will equip you with the knowledge and tools needed to capitalize on the ever-expanding online market. Whether you have prior experience or not, we will show you how to innovate, connect, and ultimately achieve profitability through providing financial planning services. With the help of BackersHub.com, where possibilities meet profitability, you can embark on a rewarding journey towards financial success in the digital realm.

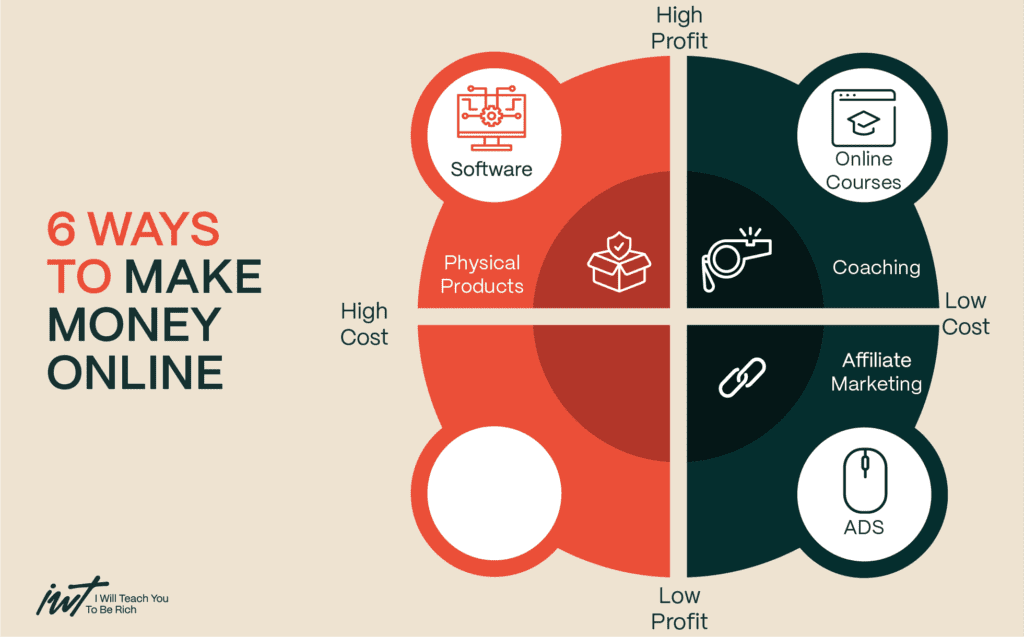

This image is property of www.iwillteachyoutoberich.com.

Unlock Earning Power: My $7 Mega Link Secret Revealed!

Step 1: Selecting a Niche

When starting a financial planning services business, it’s important to select a niche that aligns with your expertise and interests. To do this, you need to first identify your target market. Consider the demographics, interests, and financial goals of your potential clients. This will help you tailor your services to their specific needs and preferences. Additionally, research the demand and competition in your chosen niche. Understanding the market will give you insight into the potential for growth and profitability. Once you have a clear understanding of your target market and the level of competition, choose a specialized area within financial planning that sets you apart from others in the industry.

Step 2: Acquiring the necessary skills

To succeed in the financial planning services industry, you need to gain knowledge and expertise in the field. This can be achieved through a combination of education, training, and hands-on experience. Consider obtaining relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These certifications demonstrate your commitment to professionalism and uphold industry standards. Additionally, take advantage of professional development opportunities such as attending workshops, seminars, and conferences. By continually learning and expanding your knowledge, you’ll be better equipped to provide valuable financial planning services to your clients.

This image is property of miro.medium.com.

Life-Changing: How a Simple Link Brought Me Financial Freedom!

Step 3: Building an online presence

In today’s digital age, having a strong online presence is essential for any business, including financial planning services. Start by creating a professional website that showcases your services, expertise, and contact information. Your website should be user-friendly and visually appealing. Optimize it for search engines by including relevant keywords in your content, meta tags, and headings. This will help potential clients find you when they search for financial planning services. Additionally, utilize social media platforms to reach potential clients. Regularly post informative and engaging content related to financial planning, and interact with your audience to build relationships and establish credibility.

Step 4: Developing your service offerings

When developing your service offerings, consider the types of financial planning services you want to offer. This can include retirement planning, investment management, tax planning, or estate planning, among others. Determine your pricing structure based on the complexity and value of your services. It’s important to strike a balance between affordability for clients and profitability for your business. Additionally, consider offering additional value-add services such as financial education workshops or personalized financial dashboards. These extras can set you apart from your competitors and provide additional revenue streams.

This image is property of fastercapital.com.

Daily Payday From Your Couch? Try now for the cost of a cup of coffee!

Step 5: Establishing credibility and trust

Establishing credibility and trust is crucial in the financial planning services industry. Showcase testimonials and client success stories on your website to demonstrate the positive impact you’ve had on your clients’ financial lives. Encourage satisfied clients to leave positive reviews and ratings on online platforms to further enhance your reputation. Networking within the industry is also essential for building relationships and gaining referrals. Attend industry conferences, join professional organizations, and participate in online communities to connect with other professionals and potential clients.

Step 6: Marketing and promoting your services

To attract clients and grow your business, you need a comprehensive marketing strategy. Start by identifying your target audience and craft targeted messaging that speaks directly to their needs and aspirations. Utilize content marketing to educate and attract customers by creating valuable and informative blog posts, videos, or podcasts. Share this content on your website and social media platforms to establish yourself as an industry thought leader. Explore advertising options such as Google Ads or Facebook Ads to reach a wider audience. Consider forming partnerships with complementary businesses or influencers to expand your reach.

This image is property of miro.medium.com.

Shocking! This one link can pay you time and time again!

Step 7: Providing exceptional customer service

In the financial planning services industry, exceptional customer service is key to client satisfaction and retention. Offer personalized financial advice that takes into account each client’s unique circumstances and goals. Respond promptly to client inquiries and provide regular updates on the progress of their financial plans. Consistently exceed customer expectations by going the extra mile, whether it’s providing additional resources or offering proactive advice. By delivering outstanding service, you’ll not only retain your existing clients but also attract new ones through positive word-of-mouth.

Step 8: Leveraging technology and tools

Make use of financial planning software and tools to streamline your processes and enhance your services. These tools can help you create financial plans, manage client portfolios, and track progress towards financial goals. Additionally, explore automation opportunities such as setting up automatic email responses or scheduling software to save time and improve efficiency. It’s also important to stay updated on industry trends and technological advancements. Attend webinars or read industry publications to keep abreast of the latest developments, as they may provide opportunities to improve your services or gain a competitive edge.

This image is property of miro.medium.com.

Unlock Earning Power: My $7 Mega Link Secret Revealed!

Step 9: Continuously improving and expanding

To stay ahead in the financial planning services industry, it’s important to continuously improve and expand your offerings. Seek feedback from clients to understand their needs and implement improvements in your services. Listening to your clients will not only help you meet their expectations but also build loyalty and trust. Additionally, invest in ongoing professional development to stay up to date with the latest industry knowledge and trends. Consider pursuing advanced certifications or attending specialized training programs. Lastly, explore opportunities for expanding your service offerings, whether it’s through partnering with other professionals or branching out into related areas of financial planning.

Step 10: Building a reliable client base

Building a reliable client base is essential for the long-term success of your financial planning services business. Focus on client retention by consistently delivering value and maintaining strong relationships. Nurture long-term relationships by keeping in touch with clients, providing regular updates, and offering ongoing support. Implement loyalty and reward programs to incentivize clients to refer others to your services. Word-of-mouth referrals from satisfied clients can be a powerful source of new business. Continually exceed client expectations, and consistently deliver exceptional service, and your client base will continue to grow and flourish.

Life-Changing: How a Simple Link Brought Me Financial Freedom!