Municipal bonds serve as a pivotal financing tool for state and local governments, providing essential capital for infrastructure and public projects. As the present financial atmosphere fluctuates with shifting interest rates and varied investor sentiment, the municipal bond market finds itself at a critical juncture. With municipal bonds characterized by their tax-exempt status, they attract a diverse pool of investors looking for safe yet rewarding avenues for their capital. However, recent market dynamics highlight both opportunities and challenges that necessitate a closer examination of current trends in the sector.

As of recent trading sessions, the municipal bond market exhibited a steady performance, although it faced a slightly weaker undertone amid mixed closures for U.S. Treasuries and equities. Yield movements reveal intriguing patterns: while Triple-A yields saw incremental increases—ranging from one to two basis points—U.S. Treasuries displayed mixed results with noticeable weakness on the short end and mild improvements on the long end. The yield ratios between municipal bonds and U.S. Treasuries suggest a market in transition, with the short-term ratios hovering around 61% to 65% while the long-term ratio reached 80%.

This yield behavior underscores a broader narrative of investor response to persistent inflationary pressures, as highlighted recently by market analysts. A significant contributing factor to the current yields is the consumer price index data reflecting inflation in line with market expectations. Such inflation has consistently pushed yields upward, illustrating the challenge of maintaining attractive returns in a climate of rising prices.

Moreover, investors are acutely aware that the Federal Reserve is positioned to adjust interest rates, potentially implementing a 25 basis point cut in the upcoming December meetings. Market analysts predict this cut could provide necessary technical support for municipal bonds, particularly as the new year commences. In this context, the lingering volatility expected in December may pave the way for enhanced performance of municipal bonds, largely predicated on the interplay between rates and investor demand.

Despite the anticipated support from Federal Reserve strategies, the inclusion of expectation-setting is crucial as historical trends reveal a tendency for buyers to exhibit reticence during year-end financial assessments. The upcoming months may present periods of turbulence, especially for accounts that may be compelled to liquidate positions as a result of year-end assessments or to meet cash requirements.

As we analyze recent issuance trends within the municipal bond market, a marked decrease signifies a forthcoming slowdown. Following the final week of robust issuance featuring a notable $1.5 billion deal from the New York Transitional Finance Authority, this week’s issuance is projected to shrink to an estimated $2.5 billion. Such contractions call attention to investor behavior, particularly in light of recent data showcasing outflows from municipal mutual funds after a lengthy inflow streak. The recorded outflows of approximately $316.2 million reflect underlying challenges, despite the appeal of high-yield segments outpacing investment-grade offerings.

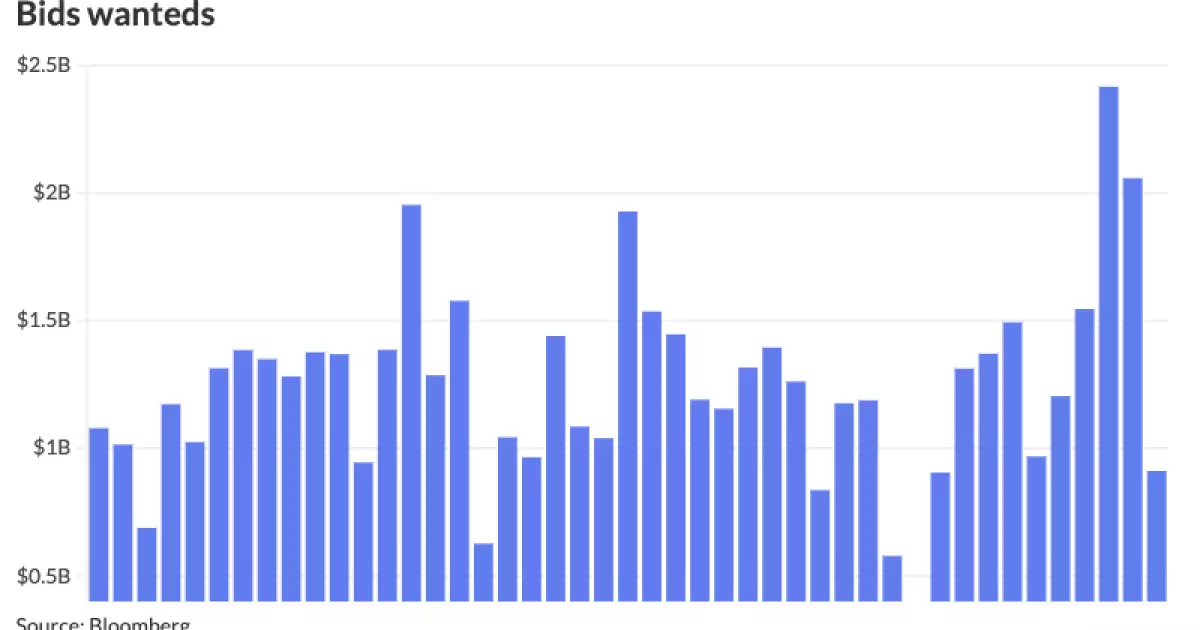

Moreover, observations point to a significant rise in bid wanted lists, indicating that institutional investors are actively seeking opportunities amid a structural downturn. This phenomenon, marked by a 62% uptick average over the preceding weeks, reveals strategic actions among buyers who are leveraging tax-loss selling to capitalize on the remaining liquidity of the year.

In forecasting the municipal bond sector’s trajectory, multiple considerations emerge. Technical factors will remain influential as potential net supply constraints loom for January and February, potentially reaching a negative $19 billion—historically more supportive than previous averages. With bond buyers meticulously navigating potential pitfalls, it remains crucial to assess the external economic indicators and Federal Reserve policies that will undoubtedly shape the market in 2024.

As we approach the year’s end, investor sentiment toward municipal bonds should be closely monitored. The interplay between municipal yields, consumer price index readings, and Federal Reserve policy will play a principal role in directing market trends. The crucial challenge will be in reconciling the attractive nature of municipal bonds with fluctuating yield expectations while ensuring that investors remain forthcoming in their engagement with this essential sector.

Understanding these dynamics, along with ongoing market fluctuations, will be vital as investors seek to protect their portfolios and position themselves for emerging opportunities in the ever-evolving world of municipal finance.