As the financial landscape shifts under the looming Federal Open Market Committee (FOMC) meeting, the municipal bond market, alongside U.S. Treasuries, is grappling with a mix of tension and cautious optimism. Recent trends reveal a complex interplay between market expectations, yield fluctuations, and the economic forecast as investors navigate these uncertainties.

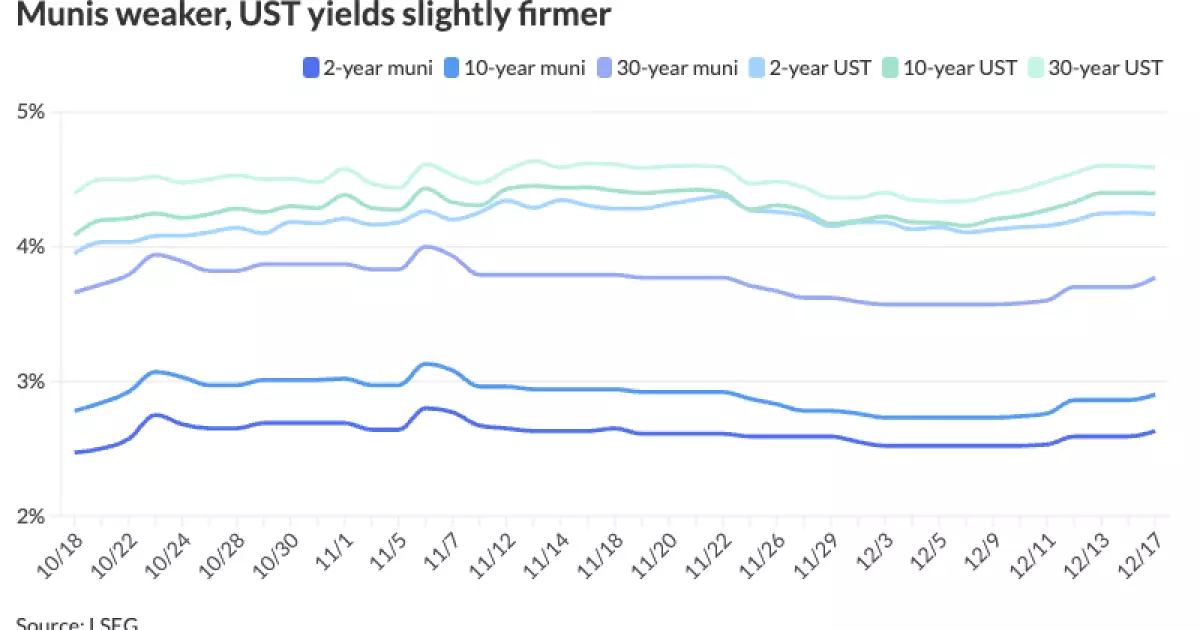

The municipal bond market exhibited signs of weakness in the lead-up to a pivotal FOMC meeting, where a quarter-point interest rate cut is widely anticipated. Participants in this space are wary, given that the previous week marked a downturn. The New York City Transitional Finance Agency‘s issuance, which represents one of the final significant new issues for the year, has not provided the impetus needed to enhance market sentiment. Analysts have observed that municipal bond yields for top-tier issuers increased by two to seven basis points, a trend reflecting a cautious approach among investors.

The ratios comparing municipal securities to U.S. Treasuries (USTs) have also fluctuated, suggesting an evolving preference among investors. These ratios, which stood at 62% for two-year bonds and climbed to 82% for 30-year bonds, indicate that while treasuries remain slightly appealing, there is an underlying concern about the sustainability of tax-exempt financing.

A significant theme emerging from discussions around the FOMC meeting is the ambiguity surrounding future rate decisions. Market analysts, like Giles Nicholson of Siebert Williams Shank, emphasize a sentiment of uncertainty, where investors are trying to peer beyond the proposed rate cut. The crux of the debate hinges on economic indicators that could support further cuts in 2024 or suggest a stabilizing economy. As Nicholson noted, if further cuts seem off the table, it may signify a healthier-than-anticipated economic backdrop.

This indecision is further magnified by contending views on federal deficits, projected to balloon tremendously over the next decade, adding pressure to the treasury supply-demand equation. In particular, the Congressional Budget Office forecasts that the U.S. will require an additional $22 trillion in treasury supply, a projection likely to weigh on market conditions indefinitely. Such expectations could potentially catalyze a selloff in USTs if investors feel overly burdened by impending deficits.

As the market braces for significant treasury issuance over the next ten years, expectations grow murky. Not only will tax cuts likely fuel deficits, but there is also a growing concern about the implications for municipal bonds. As noted by Matt Fabian from Municipal Market Analytics, there is apprehension that increasing federal deficits will distort local funding mechanisms and strategies, potentially stifling growth.

With this larger economic context, municipal yields saw varying movements last week, with cuts recorded in the range of four to twelve basis points. The challenge remains evident: market participants anticipate a busy upcoming quarter, with a projected influx of municipal issuances that could further strain market dynamics unless managed correctly.

Despite the current negatives, it is noteworthy that year-to-date municipal issuance has reached a staggering $492 billion, with forecasts for 2025 suggesting it could surpass $500 billion. This boom appears tethered to infrastructure projects, with municipalities poised to leverage favorable market conditions for funding initiatives. Notably, significant deals are already in the pipeline, including potential offerings from San Francisco International Airport and the University of California, with billions at stake in the upcoming pricing periods.

Given these anticipated issuances, market dealers are gearing up for a potentially dynamic first quarter. Factors such as the desire for tax-exempt financing in a tightening fiscal landscape and an increase in supply could pressure yields to rise, particularly in higher-coupon bonds that promise better returns.

As we await the outcome of the FOMC meeting and the subsequent impact on market rates, the overarching sentiment among investors remains one of caution. The impending changes in the fiscal framework, ongoing discussions around federal deficits, and evolving yields will shape the future trajectory of both the municipal and treasury markets. As the landscape continues to reveal opportunities amid uncertainties, investors are advised to maintain vigilance, ready to adapt strategies in response to slight pivots in market sentiment. Whether the anticipated rate cuts provide the needed relief or simply foreshadow further challenges, only time will tell how these dynamics fully unfold.