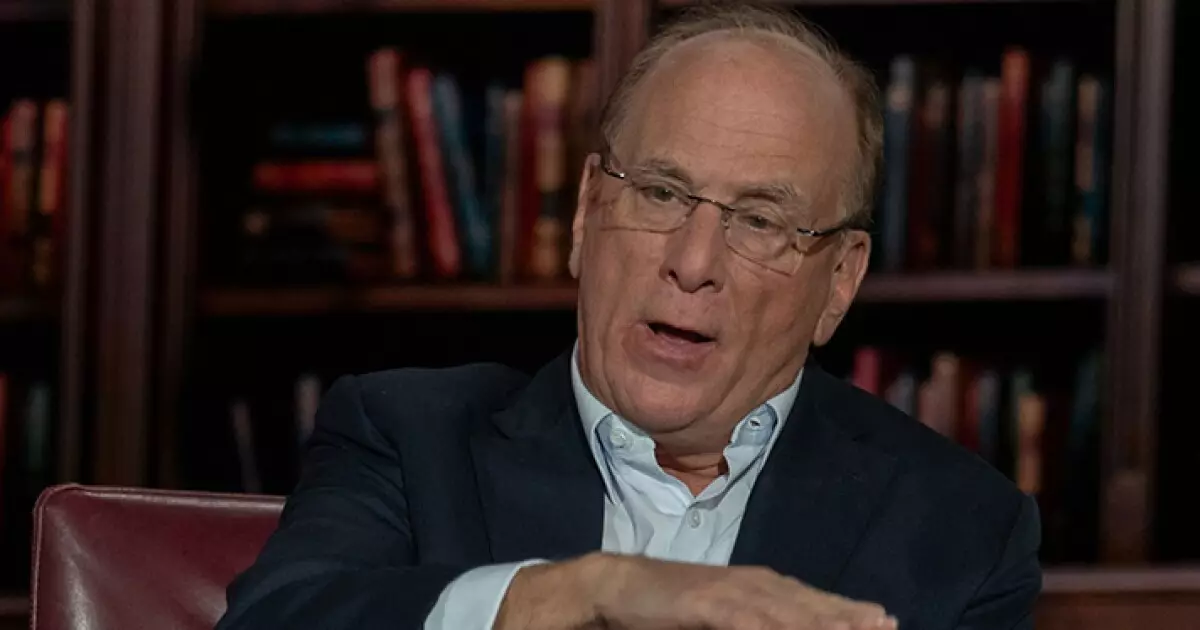

Infrastructure demands in the United States are reaching critical levels, with public debt unable to bridge the funding gap required for necessary upgrades and transitions to decarbonization. Larry Fink, CEO of BlackRock, emphasizes the importance of public-private partnerships and investment funds in addressing these challenges. Fink highlights the need for private capital to fill the infrastructure funding gap, finance the energy transition, and drive U.S. economic growth in the face of mounting debt.

Despite recent investments in infrastructure by the Biden Administration, there remains a significant backlog of $2 trillion in deferred maintenance in the United States. This is exemplified by recent incidents such as the collapse of Baltimore’s Francis Scott Key Bridge and a section of California’s Highway 1 falling into the ocean. The American Society of Civil Engineers estimates that $2 trillion is required to bring U.S. infrastructure up to a state of good repair.

In addition to addressing failing infrastructure, the transition to renewable energy presents another substantial financial challenge. Estimates suggest that global decarbonization efforts over the next 30 years could cost $100 trillion, including climate adaptation needs. Goldman Sachs projects that $6 trillion annually will be needed this decade to decarbonize the globe. While municipal markets and federal funds are expected to cover a portion of these costs in the U.S., private capital markets and investment funds will play a crucial role in closing the funding gap.

The Role of Public-Private Partnerships

Fink emphasizes that traditional government funding will not be sufficient to meet the infrastructure and decarbonization needs of the 21st century. He argues that public-private partnerships will be essential in driving investment and innovation in these critical areas. Private firms that own key infrastructure assets, such as cell towers and pipelines, are also seeking financing partners to support their growth and sustainability initiatives. By leveraging the power of the capital markets through public-private partnerships, the costs of decarbonization can be reduced, making it more accessible and affordable for consumers.

Investing in infrastructure through public-private partnerships and innovative financing models is crucial for driving economic growth, addressing infrastructure challenges, and facilitating the transition to a more sustainable future. As the United States grapples with mounting debt and urgent infrastructure needs, collaboration between public and private sectors will be essential in closing the funding gap and building a more resilient and efficient infrastructure system for the future. By harnessing the power of the capital markets and fostering collaboration between government and private investors, the U.S. can pave the way for a more sustainable and prosperous future for generations to come.