The U.S. dollar faced a decline on Monday as investors awaited the outcome of the latest Federal Reserve meeting. At 04:45 ET (08:45 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, was trading 0.2% lower at 105.630. Despite the drop, the dollar had still seen strong gains of over 1% so far in April after climbing to 106.00 on Thursday. Traders have been adjusting their expectations for early rate cuts by the Fed following Friday’s PCE price index data, which showed higher than expected inflation for March, indicating that rate cuts might be delayed.

The upcoming Federal Reserve meeting, scheduled to conclude on Wednesday, has become the center of attention for currency markets. Analysts are predicting that the central bank will maintain its current interest rates and potentially provide a more hawkish outlook, given the recent trend of U.S. inflation remaining stable. The latest PCE figures have reinforced the notion that inflation is on the rise, and with strong jobs data from last month, Chair Jerome Powell is likely to adopt a more cautious stance on the possibility of rate cuts. The market is eagerly awaiting Friday’s monthly jobs report, which will offer insights into the state of the U.S. labor market. Economists are anticipating an addition of 243,000 jobs in April, with the unemployment rate expected to hold steady at 3.8%.

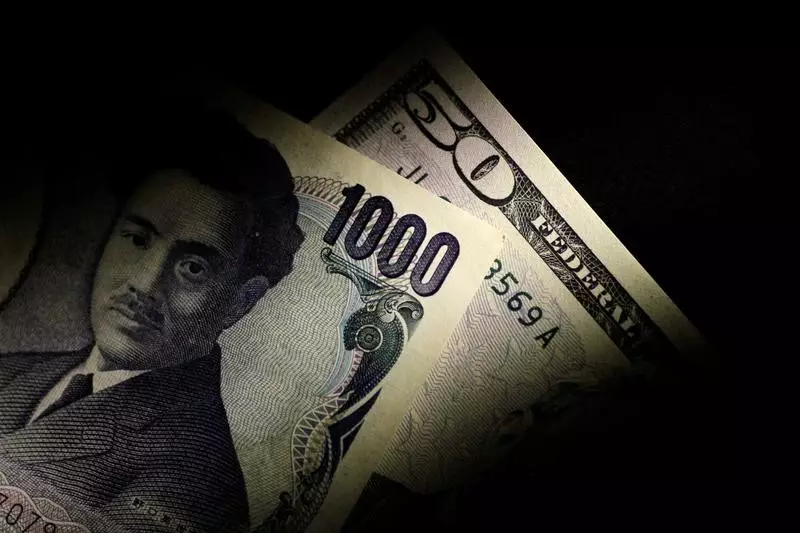

The Japanese yen experienced a significant surge on Monday in the wake of speculation that Japanese authorities might be intervening to curb its downward trajectory. USD/JPY plummeted 1.8% to 155.56 after reaching a high of 160.245 earlier in the day. Market participants have been on high alert for any signs of action from Tokyo to support a currency that has hit 34-year lows against the dollar, despite the central bank’s recent exit from negative interest rates. While Japanese officials have not confirmed any intervention, there are strong indications that steps were taken after USD/JPY touched 160.0.

In Europe, the EUR/USD pair witnessed a 0.3% increase to 1.0722 as the dollar weakened. Traders were analyzing a series of European inflation reports, including a 3.3% year-on-year rise in Spanish consumer prices in April. German states also released their consumer figures, with North Rhine Westphalia reporting numbers slightly above the European Central Bank’s 2.0% medium-term target. The ECB is planning an interest rate cut in June, but uncertainties remain due to escalating energy costs, persistent high services inflation, and ongoing geopolitical tensions. On the other hand, GBP/USD rose by 0.3% to 1.2528, benefitting from the recent weakness in the dollar. Market rates suggest expectations for a rate cut in August, but there is reluctance to price in additional cuts.

Overall, the currency markets are reacting to a combination of factors, including expectations surrounding the Federal Reserve meeting, speculation about Japanese intervention in the yen’s decline, and economic data from various regions. The situation remains fluid, and traders will be closely monitoring developments in the coming days to adjust their positions accordingly.