The municipal bond market, often viewed as a safe haven for investors seeking tax-exempt income, is currently struggling against rising U.S. Treasury yields and an uptick in equities. While the municipal market demonstrated a commendable gain of 0.99% in February—a month described as “strong” by experts—widespread changes loom that could foretell instability. The latest statistics reveal a sobering 64% ratio of two-year municipals to U.S. Treasury securities, inching upwards to 87% for 30-year offerings. This ratio highlights the inherent risk within munis where the allure of tax-exempt income competes with increasing yields from Treasuries.

A Looming Headwind: Supply and Demand Dynamics

As we delve deeper, the supply challenges become alarmingly evident. A projected net supply of $7 billion this month indicates that issuance will likely outstrip coupon payments and redemption amounts. This could create significant pressure on the market as investors may liquidate assets to cover tax obligations. The potential increase in selling pressure cannot be understated and may become a prevalent theme during the tumultuous tax season. It’s a sobering reminder that even in a robust market, factors lurk that can unshake an otherwise steady foundation.

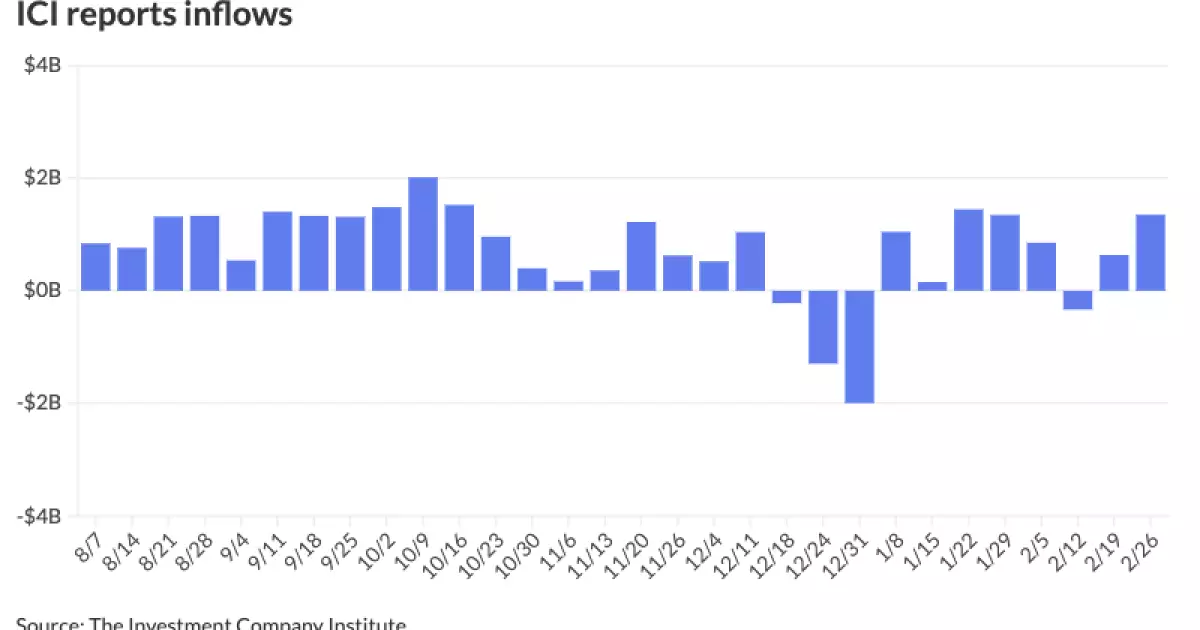

Yet, amidst the chaos, there is a glimmer of hope. Daryl Clements of AllianceBernstein suggests that continual strong inflows may offset some of this selling pressure. According to figures from the Investment Company Institute, investors have injected approximately $1.35 billion into the muni market within the last week alone, with year-to-date contributions reaching around $6.178 billion. However, this positive sentiment is undercut by the stark reality of supply—February issuance stood at an impressive $34.8 billion, pushing total 2023 issuance above last year’s figures.

Prospective Infrastructure Needs: The $1 Trillion Question

As the discussion shifts to infrastructure spending, it bears noting that some market analysts deem the municipal bond market “structurally undersupplied.” Observations from experts like Wesly Pate indicate that the market would absorb heightened levels of issuance with relative ease. In fact, estimates suggest that the market needs an annual issuance of $750 billion to $1 trillion to effectively address the nation’s infrastructure needs. This is a strikingly high bar, especially when you consider the shift of funding responsibilities to the federal level. The nexus between municipal bonds and infrastructure spending is one that requires urgent attention to mitigate the looming challenges.

When we reflect on the government’s approach to infrastructure financing, it becomes clear that we are witnessing a crucial disconnect. Despite the wealth of available capital in the municipal market, the current structures and policies seem inadequate in mobilizing these resources effectively. Reform is necessary—not just for market participants, but for the very fabric of the nation’s infrastructure.

Market Responses: Both Promising and Problematic

As we analyze the ongoing activity within the primary market, it becomes evident that some entities are adapting swiftly to these multifaceted challenges. For instance, significant offerings from reputable institutions such as the New York City General Obligation bonds illustrate a proactive approach despite yield adjustments. However, even as these institutions seek to penetrate the market, caution must prevail. The mere presence of offerings does not guarantee investor confidence, which is paramount amidst the swirling uncertainties.

Interestingly, the competitive market has also illustrated diversity in yield offering strategies to spur interest. Yet, it raises a larger question: are lower yields fostering genuine interest, or merely masking underlying concerns? The absence of substantial investor enthusiasm could signal doubt about the health of municipal debt, and with tax-deferred assets becoming increasingly coveted in uncertain times, savvy investors must tread carefully.

Viewing the Future: High-tech Solutions and Blockchain Disruptions

Amidst the traditional methods of pricing municipal bonds, recent advancements like ficc.ai’s blockchain-powered pricing model bring a refreshing disruptor into play. This innovative approach promises to enhance market transparency and accessibility. Such technology not only offers a glimpse into the future of bond pricing but also raises critical questions regarding the traditional practices that have long dominated the landscape.

The looming question remains: will these technological advancements level the playing field for all investors, or will they entrench existing monopolies under a new guise? The answer will depend on how effectively the industry adapts to evolving dynamics while remaining anchored in principles of transparency.

As the municipal bond market wades through turbulent waters, one thing is clear: stakeholders must remain vigilant and adaptable. The complex interplay of economic conditions, investor behavior, and innovative technological disruptions could serve as either a fulcrum or a dead weight—and in such a rapidly changing landscape, the stakes have never felt higher.