The recent surge in copper prices has caught the attention of investors and analysts alike. With the futures contract for May delivery of copper reaching its highest level since January 2023, touching $4.2565 on Thursday, many are looking for opportunities to capitalize on this trend.

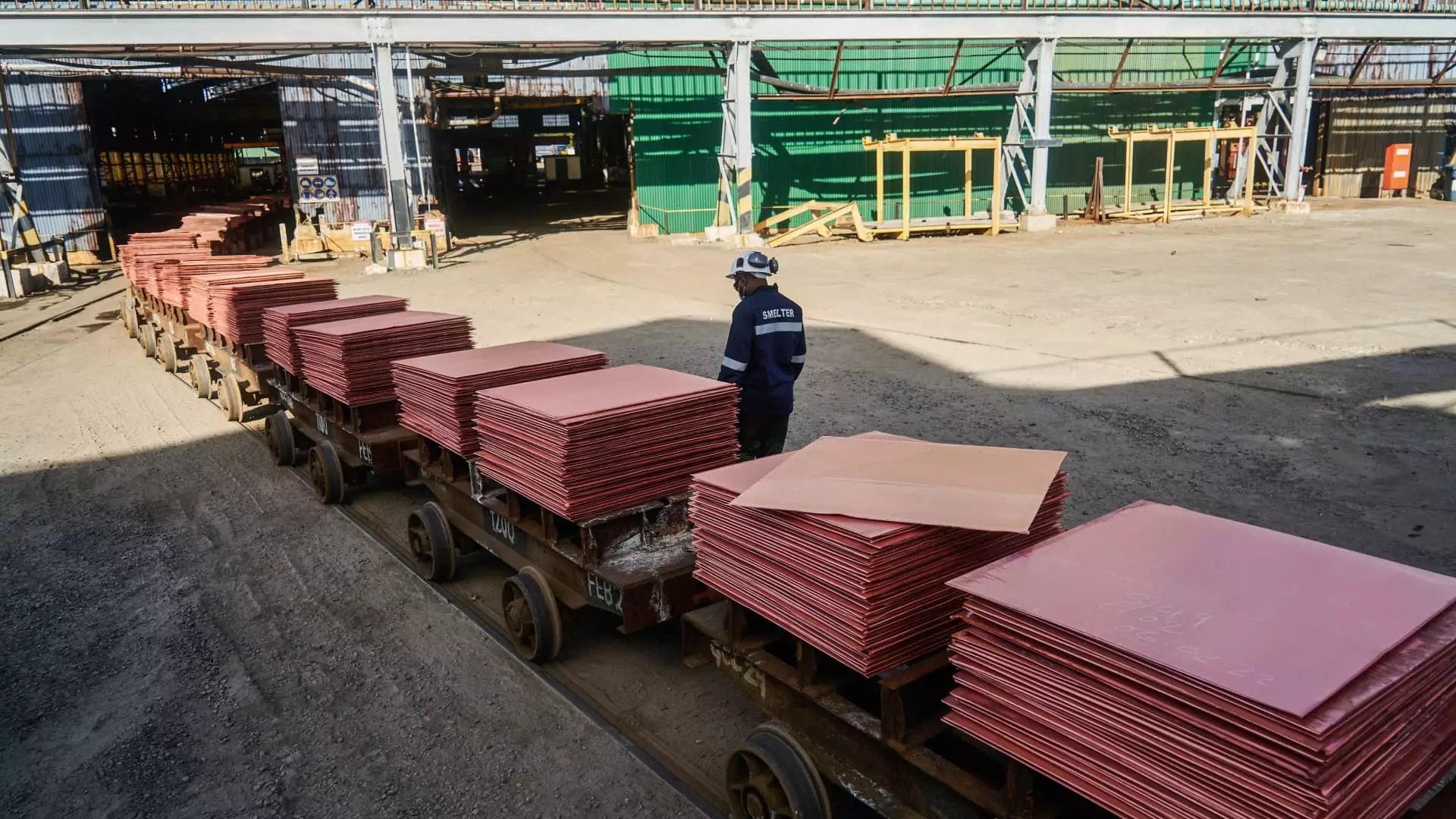

According to Chris Verrone, head of Strategas’ technical strategy and macro research team, there are certain stocks that are poised to benefit from the rise in copper prices. He has identified stocks with exposure to the metal that are breaking out of their multi-year ranges. Some of the U.S.-listed tickers he highlighted as having the highest correlation to copper in the last decade include Freeport-McMoRan and Southern Copper.

Freeport-McMoRan, a copper mining company, has seen a 16% rally so far this year. While some analysts have a positive outlook on the stock, others are more cautious. Just over half of analysts covering Freeport-McMoRan rate it a buy, with the average price target suggesting a 3% downside from current levels. However, Bernstein analyst Bob Brackett sees a potential catalyst in the form of Indonesia extending a special mining license for Freeport-McMoRan’s Grasberg mine, which could lead to significant growth opportunities.

On the other hand, Southern Copper has experienced a 28% surge in its stock price this year. Despite this, half of the analysts covering the stock have a negative view, rating it underperform and suggesting a 29% downside from current levels. However, Jefferies analyst Alejandro Anibal Demichelis believes in the company’s potential, upgrading the stock to a buy rating and raising the price target significantly. He sees an improving copper price outlook as a key driver for future growth for Southern Copper.

The rise in copper prices presents opportunities for investors to consider stocks like Freeport-McMoRan and Southern Copper. While there are differing opinions among analysts about these companies, the overall sentiment seems to be positive regarding their potential for growth in the coming months. It will be interesting to see how these stocks perform in light of the current market conditions and the outlook for copper prices.