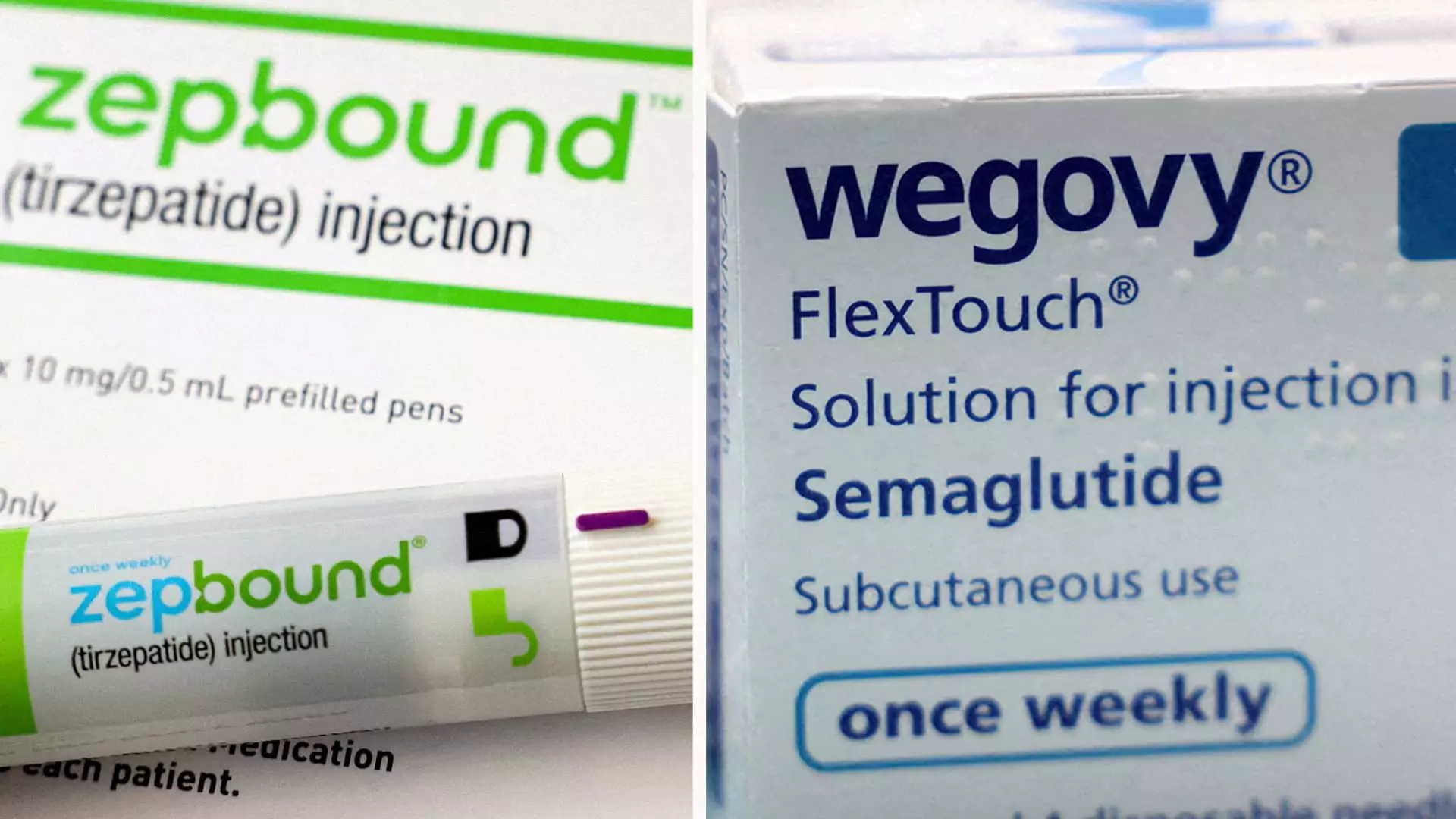

The management of obesity has taken a significant leap forward with the emergence of two prominent medications: Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy. Recent developments have illuminated a competitive landscape that is rapidly transforming as Zepbound reportedly demonstrates superior efficacy in weight loss compared to Wegovy. The implications of these findings could reshape treatment paradigms and influence the choices of both healthcare providers and patients.

On Wednesday, Eli Lilly released new data from a pivotal head-to-head clinical trial that highlighted Zepbound’s effectiveness, showcasing an average weight loss of 20.2% over a 72-week period. This statistic translates to approximately 50 pounds for the typical participant, significantly outperforming Wegovy, which facilitated an average weight loss of 13.7%, roughly equating to 33 pounds after the same duration. This breakthrough suggests that Zepbound could position itself as a frontrunner in the obesity treatment market.

The depth of the trial offers more than just anecdotal evidence; it involved a randomized assignment of 751 patients, all classified as overweight or obese, with at least one weight-related medical condition other than diabetes. The rigorous methodology employed in this study enhances the credibility of the results, enabling healthcare providers to make more informed decisions concerning obesity management options available to their patients.

Eli Lilly’s findings revealed remarkable statistics regarding the relative weight loss evoked by Zepbound. Participants taking Zepbound experienced a 47% higher relative reduction in weight compared to their Wegovy counterparts. Not only did more patients on Zepbound manage to reach significant weight milestones—31.1% achieved a 25% weight loss threshold—but only 16% of those treated with Wegovy reached the same outcome. These numbers not only reflect the efficacy of both medications but also indicate a compelling narrative for Zepbound’s potential as a more effective option.

To further substantiate this superiority, Eli Lilly referenced previous studies showing similar trends in weight reduction favoring Zepbound. A late-stage study indicated an average loss exceeding 22%, while Wegovy’s past performances demonstrated a lower threshold of 15%. The converging evidence paints a promising picture for Zepbound in its battle for market dominance.

Considering the booming market for weight loss drugs, which analysts project could reach a staggering $150 billion annually by the early 2030s, Eli Lilly’s emphasis on Zepbound could dramatically alter the playing field. Despite Wegovy being the earlier entrant, Zepbound’s potentially advantageous results may set the stage for it to surpass Wegovy in sales figures and market share over time.

Current forecasts by data analytics firms speculate that Zepbound could amass $27.2 billion in sales by 2030, overshadowing Wegovy’s expected $18.7 billion in the same timeframe. As the treatment landscape continues to evolve, Zepbound’s introduction and success resonate positively with investors and stakeholders, amplifying competitive enthusiasm in the industry.

While Zepbound’s potential appears robust, it does not come without challenges. The surge in demand for weight loss medications like Zepbound and Wegovy has led both companies to invest heavily in bolstering their manufacturing capabilities. Recent moves by the Food and Drug Administration to categorize the medications as “available” reflect effective supply chain adjustments, yet accessibility remains an ongoing concern for many patients.

Insurance coverage for obesity treatments frequently varies, complicating access for those in need. At a cost of approximately $1,000 per month, the financial burden poses significant barriers, particularly for uninsured individuals. Addressing the economic aspects of these treatments will be crucial to ensuring widespread use and maximizing the benefits that these innovative drugs offer.

The recent results surrounding Zepbound signify a pivotal moment in the race against obesity. With therapeutic options like Zepbound and Wegovy shaping treatment protocols, the emphasis on individualized care becomes paramount. As more data emerges, both clinicians and patients will need to weigh the benefits and drawbacks of each medication carefully. The journey of obesity management is complex, yet advancements such as Zepbound and continued innovation may finally provide the solutions desperately needed to combat this pressing health issue.