In a notable shift, the municipal bond market experienced gains on Thursday, which marked a pause in a trend of rising yields that had persisted for four consecutive trading sessions. U.S. Treasuries also exhibited improvements within this timeframe, thus creating a mixed outcome across equities markets. The declines in municipal yields were particularly significant, with reductions of up to seven basis points reported. In contrast, U.S. Treasury (UST) yields saw a more modest drop, ranging from one to five basis points. Such movements have implications not only for investors in these markets but also for broader economic conditions and expectations.

Yield Ratios and Investor Inflows

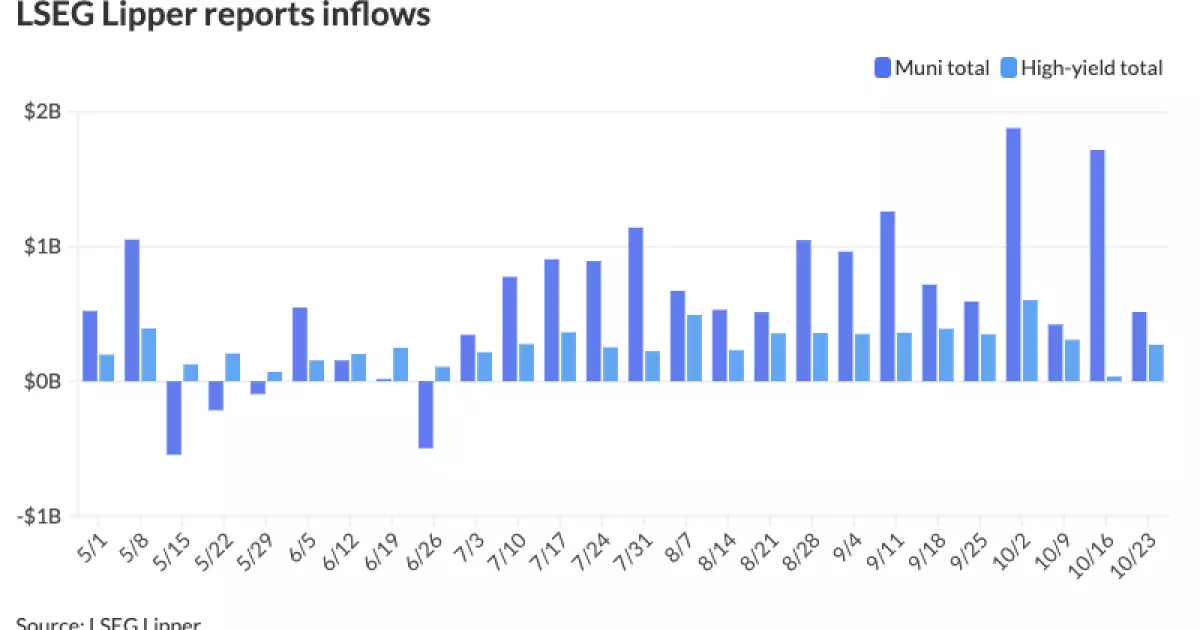

The relationship between municipal yields and UST yields is often gauged through ratios, which, on Thursday, reflected slight reductions. For instance, the two-year municipal to UST ratio settled at 66%, while the 30-year ratio was registered at 87%. These shifts indicate a changing dynamics in how investors perceive risk and return within these asset classes. The significance of inflows into municipal bond mutual funds cannot be understated; recent data from LSEG Lipper indicated that investors added $514.7 million in the latest week. This continued a remarkable streak of 17 consecutive weeks of inflows, although the amount was considerably less than the previous week’s inflow of $1.718 billion. Such patterns reveal a selective pursuit of returns, particularly as market conditions shifted in recent months.

Market Sentiment and Economic Indicators

While the initial months of a year may have brought favorable returns, October has presented challenges, leading to a decrease in total returns year-to-date to just 0.37%. Analysts like Sheila May at GW&K Investment Management pointed towards the implications of Federal Reserve interest rate movements which were anticipated but seem to be on hold after robust employment and spending figures were reported. This caused slight adjustments in investor expectations, leading to a re-evaluation of prior positive trends in returns. In this environment, caution prevails even as technical fundamentals within the market, such as credit quality, remain strong with upgrades outpacing downgrades 3.5 to 1 in 2024.

The surge in municipal bond issuance, sitting at $418.451 billion year-to-date, reflects deeper economic conditions. The 41.1% increase in issuance is indicative of ongoing inflationary pressures being managed and a reduction in federal aid, resulting in state and local governments seeking to address urgent financing needs. Industry experts anticipate further momentum in this area due to substantial infrastructure requirements. Matt Fabian from Municipal Market Analytics highlights that the need for infrastructure investments is not merely cyclical but essential, with critical maintenance backlogs estimated at a staggering $1.2 trillion for water utilities and around $1 trillion for higher education.

Market Activity and Anticipations for 2024

With substantial amounts of supply lining up for market issuance, investor sentiment remains strong, particularly for well-structured deals that offer competitive income spreads. The current robust slate of deals in the municipal market is anticipated to yield record levels of issuance heading into 2024. Experts note that while activity may taper after November 5th due to impending holidays, issuers are keen on capitalizing on favorable conditions before the close of the year. However, as issuance swells, market dynamics become increasingly complex, leading to perceptions of cheapening across segments.

Examining the interest rate landscape, the yield for various municipal bond maturities varies, with adjustments evident across AAA scales. The Refinitiv MMD’s data indicated that one-year bonds saw a decline to 2.86%, while the two-year dropped to 2.68%. Treasury yields showed similarly mixed activity, with the two-year UST yielding 4.073% and the 10-year seeing a decline to 4.207%. These fluctuations point to ongoing adjustments to investor sentiment regarding economic growth, inflation expectations, and monetary policy positioning.

The recent movements in municipal bonds and U.S. Treasuries reflect a complex interplay of market dynamics, investor sentiment, and economic indicators. Despite recent challenges in returns, a robust groundwork remains as fundamental strengths and infrastructure imperatives drive market strategies moving forward. Looking towards 2024, both opportunities and challenges lie ahead, requiring investors to remain vigilant and responsive to evolving market conditions.