The municipal bond market is once again taking center stage as market participants grapple with shifting economic indicators and Federal Reserve (Fed) policy. The recent fluctuations in U.S. Treasury yields and ongoing evaluations of the Federal Open Market Committee’s (FOMC) decisions have set the backdrop for a captivating period in fixed-income investing. As anticipation builds toward a potential rate cut in the upcoming FOMC meeting, it’s crucial to analyze the prevailing trends and performance within the municipal sector.

Market Stability Amid Economic Uncertainty

Despite an environment of economic unpredictability, municipal bonds have remained relatively stable, displaying slight firmness in certain areas. As Cooper Howard, a fixed-income strategist at Charles Schwab, noted, the market expectations suggest a strong likelihood of a Fed rate cut this week, yet the specifics regarding the magnitude of this cut remain uncertain. Such monetary policy shifts typically create favorable scenarios for both taxable and tax-exempt bonds, as lower rates improve price appreciation potential. In fact, relative to historical performance metrics during previous dovish periods, current nominal yields appear quite appealing, with substantial upward price movement anticipated if the Fed acts as expected.

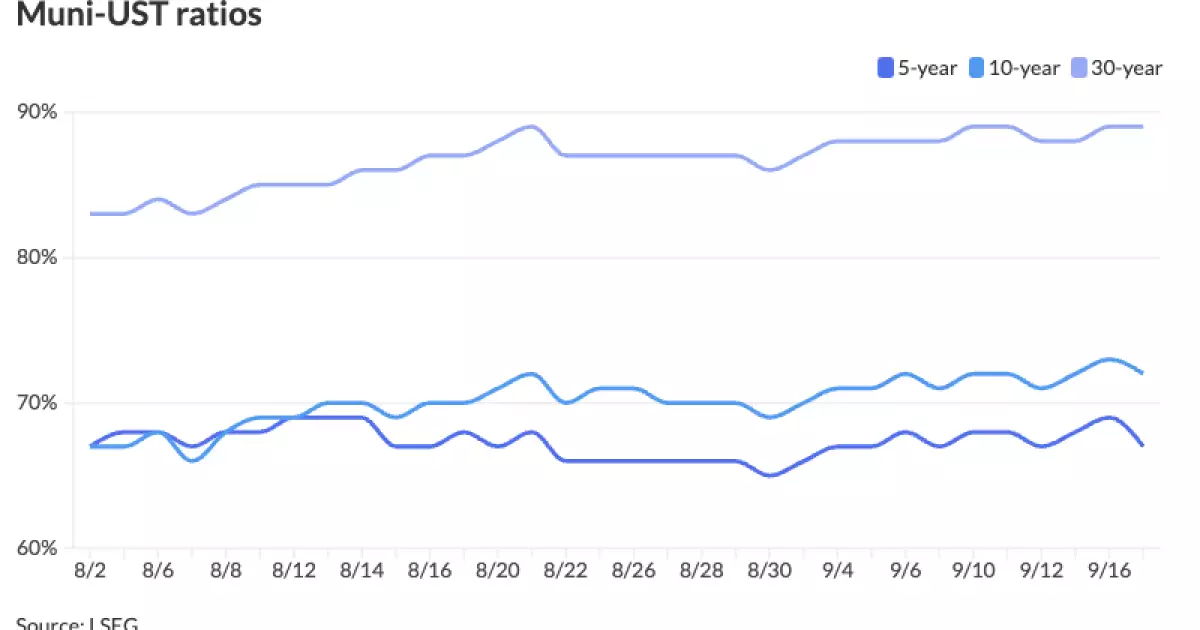

However, it’s essential to acknowledge that municipal bonds have been lagging behind their U.S. Treasury (UST) counterparts this year. Data shows that while the municipal market offers a year-to-date return of 2.04%, USTs and corporate bonds have outperformed, returning 2.98% and 5.87%, respectively. Despite this underperformance, it brings to light an intriguing silver lining: the improved relative valuations. Price ratios seem favorable, with the two-year muni-to-Treasury ratio resting around 65%, and ratios across longer durations offering attractive comparisons as well.

The Outlook for Munis: Mixed Signals

The divergence in performance raises questions about the future trajectory of municipal bonds. Experts suggest that while market prices have firmed, caution is warranted. The reality remains that many tax-exempt municipal bonds have underperformed significantly compared to USTs and taxable equivalents, which raises concerns about the stability of demand in the face of potential rate cuts. As Matt Fabian from Municipal Market Analytics highlights, investors must cautiously consider how income-oriented separately managed accounts (SMAs) might react to evolving yield scenarios.

Furthermore, even as 2a7 assets have expanded by $40 billion, there appears to be hesitance within money markets. Some of these funds may remain reluctant to flow into new investments, particularly if allocations are tied to certain strategies. This could hinder overall market liquidity and slow the anticipated rally in tax-exempt yields, especially if demand does not accelerate in correspondence with favorable rate movements.

In the primary market, recent activities reveal a robust appetite for municipal bonds even amid existing concerns. Major institutions have successfully priced several significant bond offerings, reflecting steady issuer confidence and investor interest. For instance, J.P. Morgan’s pricing of $476.585 million in electric system revenue bonds for the Jacksonville Electric Authority indicates a generally favorable market environment. This series featured various tiers ranging from 2.50% to 3.36%, showcasing competitive returns across maturities.

Other noteworthy issuances from Bank of America demonstrate ongoing demand across different categories, including sustainable development and housing impact bonds. The pricing of taxable social bonds and revenue refunding bonds underscores a strong institutional backing for socially responsible investing.

As we move forward, the sentiment across the municipal bond market will largely hinge on upcoming Fed actions and broader economic indicators. With structural shifts in policy and potential liquidity constraints highlighted by current fiscal conditions, investors should remain vigilant and agile in their investment strategies.

The municipal bond market, while offering attractive yield scenarios, faces challenges stemming from relative underperformance compared to corporate and Treasury yields. This juxtaposition between opportunities and vulnerabilities complicates the decision-making process for institutional investors and managers of funds alike.

Conclusively, ongoing developments in the municipal landscape are sure to shape the decisions of market participants as they aim to navigate these complex waters. While cautious optimism prevails, the interplay of economic policy, investor demand, and market dynamics will unfailingly drive the next chapter in municipal bond investing.